Staying responsive and flexible to changing investment conditions has always been a hallmark of State Super’s approach to the investment strategies we offer our members. As part of this continuing evolution, a new sector has recently been added to our range of Liquid Defensive asset portfolio. It’s known as ‘Income’ and it has been introduced to enable us to better respond to the challenges of the prevailing low yield investment environment.

Why this new sector could matter to you

One of the key challenges that faces State Super’s schemes in particular is the ageing profile of the fund membership. As the average member age increases this leads to members opting for a more cautious approach to their investment and a shift toward more conservative assets. To illustrate the magnitude of this shift, the Defined Contribution Scheme currently has around 25% of funds invested in the more conservative strategy options. As the average age of our members grows older, this proportion is expected to double to around 50% over the next five years.

As State Super CEO John Livanas, explains, “The prospect of an ageing member base coupled with the pervasive low yield economic and investment environment means that we have to be proactive in building resilience into our defensive asset portfolio. We see little prospect for any significant turnaround in central bank monetary policy in the short to medium term, as they are focused on growth, full employment and sustainable inflation targets. That means rates will likely remain depressed, which makes it more difficult for Fixed Interest and Cash sectors to achieve our real return and defensiveness objectives. Our new Income sector is designed to squarely address this challenge and provide another string to our bow to achieve our objectives for our members”.

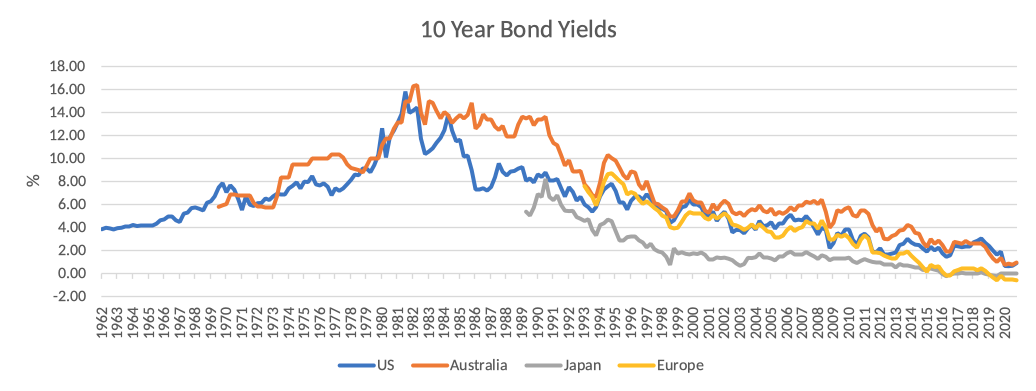

This shift toward more conservative priorities by our member base coincides with an economic and investment environment that is characterised by low yields in Fixed Interest assets. As the chart below illustrates, there has been a progressive decline in yields over the past four decades and there seems to be little prospect for any significant turnaround in the short to medium term.

Source: Bloomberg, data ending 31 March 2021

Central banks remain firmly focused on fostering growth, full employment and sustainable inflation targets, which means they will have little appetite to raise interest rates for some time to come. This will most likely leave the yields on Fixed Interest assets and rates on Cash assets in the doldrums.

State Super’s Defined Contribution scheme has specific real return and defensiveness objectives for its Liquid Defensive portfolio, but this low yield environment makes it very difficult to achieve those objectives using fixed interest and cash assets alone.

A fresh new solution to this challenge

Adding the new Income sector to the Liquid Defensive portfolio is a proactive initiative that squarely addresses this challenge and provides “another string to our bow”.

State Super CIO Charles Wu expanded further on the aims of the new Income sector. “The stated objective we have set is to produce income defensively at cash + 2% with zero to low duration and high liquidity. To achieve this, we will have core allocations in Australian investment grade corporate credit and Global investment grade structured credit. Our strategic allocation to the new Income sector will vary between our investment strategy options, ranging from 2% in our Growth Strategy up to 18% in our Conservative Strategy. The Cash Strategy (by definition) will not have any strategic allocation to Income”.

Already making a difference

The new Income sector has been gradually phased into our Liquid Defensive portfolio over the last few months and implementation was completed by March 2021. It has already provided pleasing results in terms of yield and defensiveness and we expect this to continue in the face of the prevailing economic environment.

We are confident that members will benefit from the greater resilience that this new sector will bring to our investment capability, particularly for those members who have a more conservative investment profile.